Whether it’s parents shuttling their children off to elementary school or students starting their final year of college, back-to-school season is here. We generally spend a minimum of 12 years as a student, more if you pursue a college degree. Along the way, we’re told that education is critical to your ability to earn a decent living.

But, it begs the question, do the seemingly endless nights at the library studying for exams make a difference? Does pursuing education typically translate into a higher paying job? Indeed, our analysis shows that students won’t regret pursuing a higher education. And, as housing economists, we know that a higher-paying job improves the likelihood that one can achieve homeownership.

Millennials Must Really Like School

Millennials are the largest generation cohort we’ve ever seen. While the bulk of them are turning 30 next year and solidly into their careers, many millennials are recent college graduates and newcomers to the professional world, and many are still in college.

In fact, according to our research, millennials are the most educated generation we’ve ever had by several measures. Approximately 40 percent of millennials ages 25 to 37 have a bachelor’s degree or higher, compared with just 15 percent of the Silent Generation, 25 percent of Baby Boomers and about 30 percent of Gen Xers when they were the same age. Millennials also reached the threshold of 30 percent having earned a bachelor’s degree at a much younger age than previous generations. By their mid-40s, 30 percent of Boomers had a bachelor’s degree. Gen Xers reached the mark by their early 30s, but millennials achieved the educational milestone by their mid-20s.

For millennials, it’s clear the trend is more education, and earlier in life. But, of course, education takes time and money. Millennials have delayed key lifestyle decisions, such as marriage and having children, in favor of investing in the pursuit of education, pushing marriage and family formation to their early-to-mid-30s compared with previous generations, who primarily made these lifestyle choices in their twenties. In fact, according to Census data, in the 1970s, eight in 10 people married by the time they turned 30. Today, the same level of marriage does not occur until the age of 45.

Marriage and family formation are two of the most powerful motivations for homeownership, so these delayed lifestyle choices tend to also delay the desire for homeownership. However, the earning power benefits of higher educational attainment are real.

Is the Investment Paying Off?

With all this time spent furthering their educations, and potentially accruing some student debt in the process, are millennials reaping the benefits of their investment? According to our analysis, the investment in pursuing higher education continues to deliver significant earning power benefits.

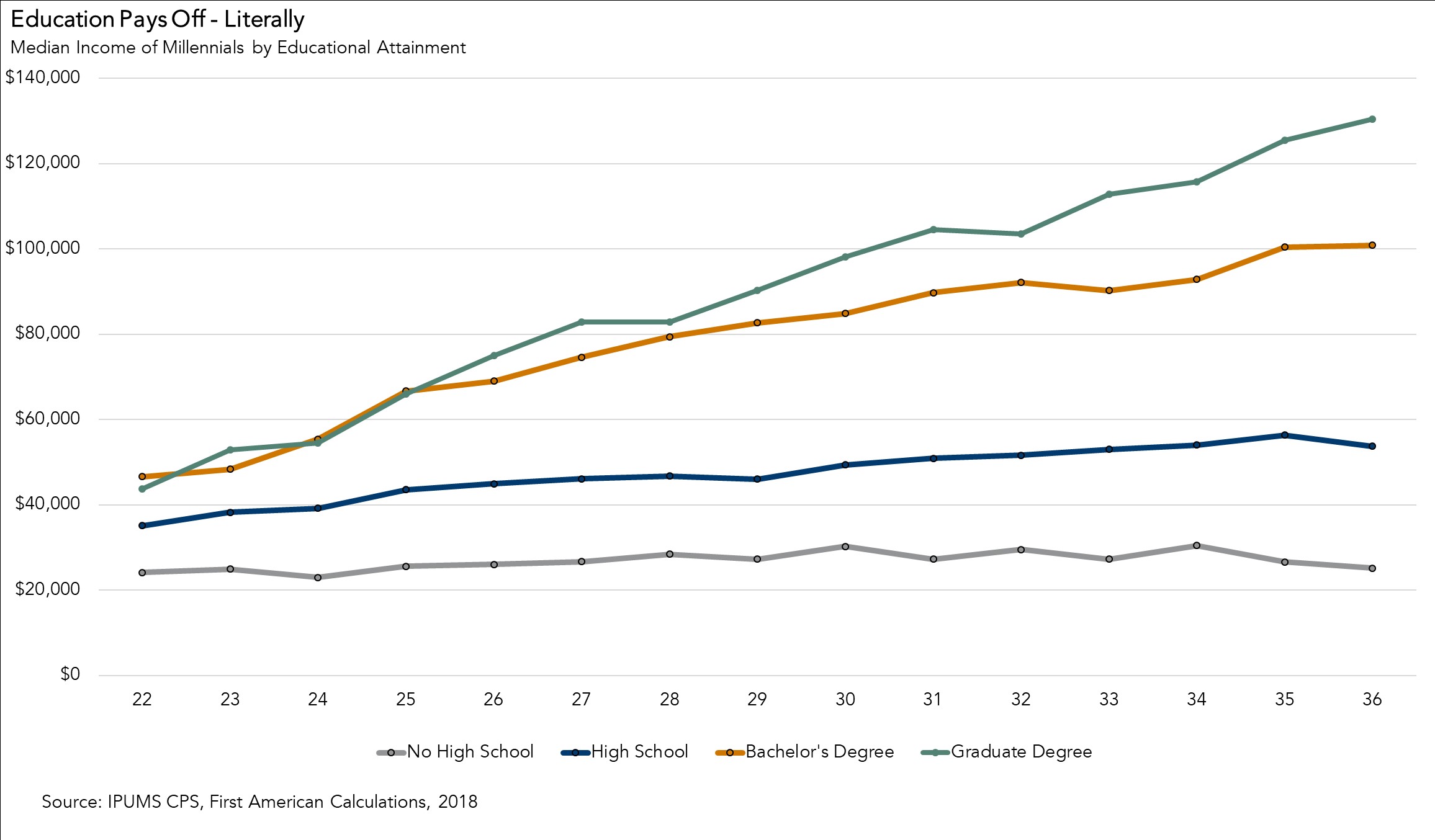

Millennials (ages 25 to 37) with a bachelor’s degree have a median household income of $86,600. That’s more than $35,000 higher than millennials with just a high school degree, whose median household income is $50,600. The discrepancy is even greater for millennials with no high school degree, which have a median household income of $28,200. The earning power benefit improves along with greater educational achievement. Millennials with at least a graduate degree have a median household income of $100,600, nearly double that of millennials with just a high school degree.

The level of educational attainment seems to matter when it comes to income growth, as well. When comparing a 36-year-old millennial to his/her younger self one decade ago, we find that those with a graduate degree or higher experienced an 74 percent increase in household income, compared with those without a higher degree, who only experienced a 19 percent gain in the decade between 26 and 36 years of age. So, the sacrifice of those early mornings, all-nighters and hours in the library pays off big time.

What’s the Implication for Homeownership?

The importance of education to homeownership has only increased over time. Our Homeownership Progress Index (HPRI)shows that the impact of educational attainment on the likelihood of homeownership has more than doubled in 20 years. In 1998, the difference in the homeownership rate between those with a high school degree and those with a college degree was 2.8 percent. By 2018, this gap widened to 6.7 percent. While the homeownership rate for millennials still lags preceding generations, we know that income is a great predictor of the likelihood of becoming a homeowner, and we know that millennials are just as interested in becoming homeowners as their predecessors were before them. So then, millennials, as you begrudgingly make your way to the library, just remember that it will all pay off, it’s just a matter of time.