Both industries rely on mortgage origination volume but while only certain transactions require MI, namely most conforming loans with less than 20% down, title insurance touches practically all transactions.

And with several major lenders

To support its business prospects, First American

Here are the results from the other publicly-traded underwriters:

Fidelity spinning out 15% of its stake in life insurer F&G

Title revenue, however, was stable on a year-over-year basis at $2.4 billion, versus $2.5 billion for the 2021 period. "Our title business was boosted by strong demand in the commercial market and home price appreciation in the residential purchase market, which offset the continued decline in refinance volumes in the rising interest rate environment," said Chairman William Foley in a press release.

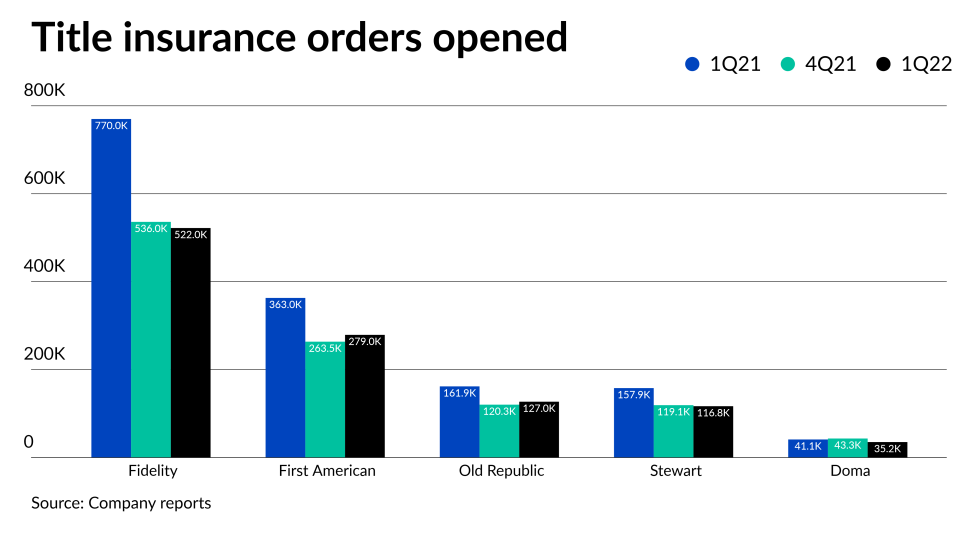

Open orders were down to 522,000 from 536,000 in the fourth quarter and 770,000 for the first quarter of 2021. FNF had 380,000 closed orders in the first quarter, versus 477,000 in the fourth quarter and 597,000 one year prior.

The company is spinning out 15% of

"Looking ahead in 2022, we believe that we are well-positioned to navigate the effects of a rising interest rate environment, with scale advantage as the nationwide market leader, efficiencies from our innovative technology enabled platform, and a disciplined operating strategy and proven track record of quickly adjusting our operating model for significant fluctuations in opened and closed orders," CEO Mike Nolan said.

Purchase orders steady at Old Republic

In its title insurance segment, pretax earnings of $80.9 million, compared with $137.3 million for the prior quarter and $103.7 million in the first quarter of 2021.

"Purchase order levels were in line with the prior period and continue to benefit from strong housing prices," the company's earnings release said.

Direct orders opened totaled 126,976 for the three months ended March 31, compared with 120,251 for the prior three months and 161,851 for the previous year. Closed orders during that time ended at 106,801 versus 113,577 and 140,281 respectively.

While premiums earned in Old Republic's run-off mortgage insurance business fell 29% year-over-year to $6.5 million in the first quarter, its pretax operating income nearly doubled to $9.7 million from $4.9 million as the company recorded a claims benefit for the period rather than claims costs.

That line item "reflect[s] significantly fewer newly reported delinquencies along with improving trends in cure rates, influenced by a relatively strong economy and real estate market," the press release said.

Stewart's income rises from prior year

Pretax income for the title insurance business rose 7% to $82.8 million from $77.1 million one year prior.

Opened orders fell to 116,755 from 157,918 last year, while closed orders fell 87,885 from 115,791.

Its real estate solutions business had pretax income of $6.8 million, compared with $2.7 million in the first quarter of 2021.

"I am pleased with the results we delivered in the first quarter 2022 in a rising interest rate environment," CEO Fred Eppinger said in a press release. "We remain optimistic on both the operating structure we continue to build as well as the long-term opportunity the market offers us given strong underlying demographic trends."

Doma retrenches, reduces workforce by 15%

However, Simkoff admitted on the call that Doma's industry share of purchase transactions in the first quarter was less than 1%. But that should grow as it brings its Doma Intelligence technology, currently primarily used for refinancings, to the purchase business.

As a result of the shift, Doma reduced its workforce by 15% last week. Of the 310 people affected, 259 were in Doma's fulfillment organization, representing a 28% reduction to that group, Simkoff said.

In addition, Doma is now looking for partners for its previously stated intention to

Doma lost $50 million in the first quarter, compared with a loss of $43.7 million in the fourth quarter and $11.8 million in the first quarter of 2021.

Open orders ended the period at 35,192; in the fourth quarter it was 43,247 and 41,048 for the first quarter of 2021. For the same time frame, closed orders ended at 27,347 from 37,042 and 32,650.

Investors Title’s net premiums written set 1Q record

Net premiums written increased year-over-year by 2.7% to $63.1 million, the best first quarter ever for Investors Title, driven by increases in average home values and a higher level of purchase activity.

"We remain optimistic about the prospects for solid results for the company in 2022" J. Allen Fine, Investor Title's chairman, said in a press release. "Regardless of cyclical changes in the real estate market, we will remain focused on profitably expanding our market presence and enhancing our competitive strengths."